Deposit Rates

Account

Minimum

Annual Percentage Yield

Shares

$5

0.10%

Checking

$0

----

Money Market

$0 - $1,999.99

0.10%

Money Market

$2,000.00 - $39,999.99

0.25%

Money Market

$40,000.00 and up

0.30%

Holiday Club

$0

0.10%

Vacation Club

$0

0.10%

Individual Retirement Account

Annual Percentage Yield

0.50%

1.25%

1.50%

1.50%

1.50%

*APY = Annual Percentage Rate. Minimum account balances are as follows: Savings - $5.00, Money Market - $2,000, Share Certificates - $500 (excluding special offers), IRAs: $500 for Accumulation account, $500 for 1 Year term, 2 Year Term, 3 Year Term and 5 Year Term. Rates listed are subject to change without notice. Transaction Limits: $500 withdrawal minimum on Money Market. Fees could reduce the earnings on the account.

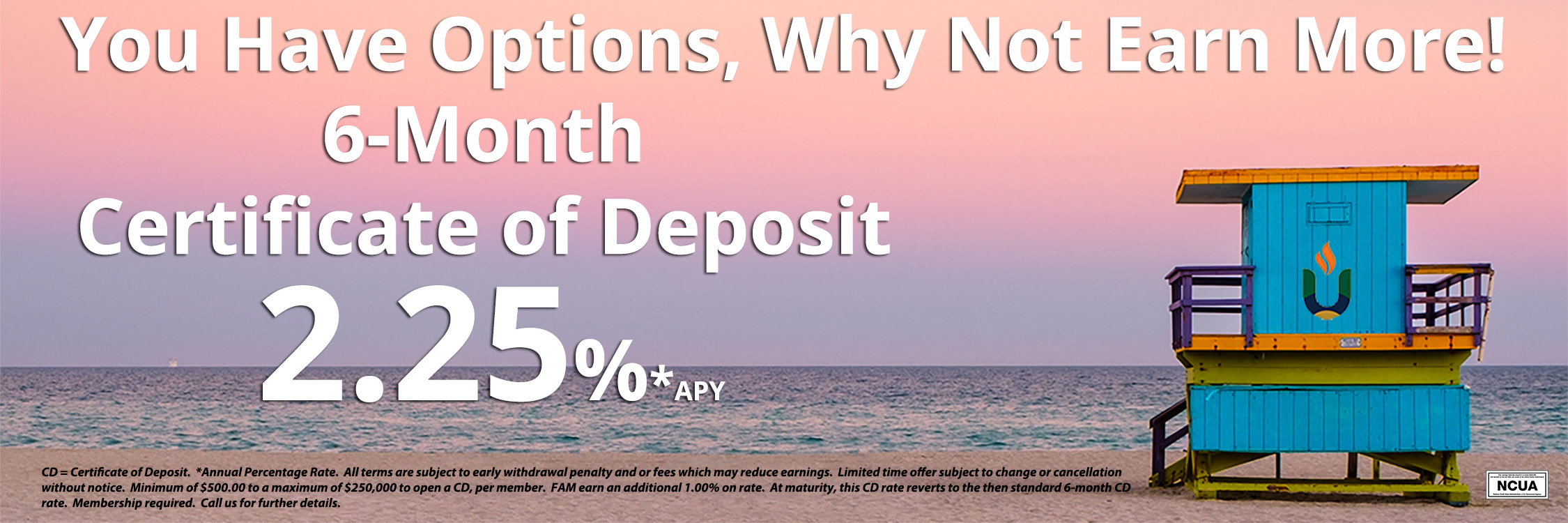

Certificate Rates

Term

Minimum

APY*

91 Days

$500

0.50%

6 Month

$500

1.00%

1 Year

$500

1.25%

2 Year

$500

1.50%

3 Year

$500

1.50%

5 Year

$500

1.50%

Early Withdrawal Penalties on Certificates of Deposit (CD):

- CDs 12 month or less, the penalty will remain at 90 days of interest whether earned or not.

- CDs greater than 12 months, but less then 5 years the penalty will be 180 days of interest whether earned or not.

- CDs 5 years or greater, the penalty will be 365 days of interest whether earned or not.

When you purchase a Certificate of Deposit (CD) you agree with University Credit Union, to keep your funds on deposit for the term of the CD. Each time you make an early withdrawal of principal, University Credit Union may charge you an early withdrawal penalty. If your account has not earned enough interest to cover an early withdrawal penalty, University Credit Union will deduct any interest first and take the remainder of the penalty from your principal.

Rates are effective as of 2/9/2026 and are subject to change without notice. All accounts are federally insured to at least $250,000 by the National Credit Union Administration, an agency of the U.S. Government.

Loan Rates

New & Used Car Loan Rates

Term | Annual Percentage Rate |

|---|---|

Up to 36 months | As low as 9.49% * |

48 months | As low as 9.49% * |

60 months | As low as 9.49% * |

72 months | As low as 9.74% * |

78 months | As low as 9.99% * |

84 months | As low as 10.25% * |

* Credit criteria apply.

APR = Annual Percentage Rate. Rates shown are the lowest possible rates currently offered. Rates are available based upon your credit profile, year of vehicle and loan terms. Credit criteria apply. Rates are fixed for the term of the loan.

Eligibility for the lowest advertised rate is based on creditworthiness, year of vehicle, ability to repay, credit score, down payment, and terms. Other rates and terms may apply and your rate may differ based on the loan program, term of repayment and other factors. UCU membership required with $5.00 minimum in savings. Member must reside in a state within UCU lending area. Other conditions may apply. Rates and Offers are subject to change without notice. Current UCU accounts must be in good-standing, not have any type of restrictions, and UCU loans paid-to-date.

Auto Loan Example: $20,000 loan at 5.49% APR with 60 monthly payments of approximately $382.86

Automobile Vehicle loans: New automobile equals Current Year and Previous Year. Loan To Values based on MSRP/Purchase price on new vehicles or the NADA Retail value plus/minus options and mileage on used vehicles. Model year restrictions apply to 84 month term on used vehicles. Used Auto equals 8 years old or newer. Other conditions may apply.

Rates, Terms and Offers are subject to change without notice. Not all applicants will qualify for the lowest rate. Rates quoted assume excellent borrower credit history. Other eligibility requirements may apply.

Other Vehicle Loan Rates

Loan Type | Term | Annual Percentage Rate |

|---|---|---|

New Motorcycle | Up to 84 months | As low as 7.99%* |

New Boat 100% (Max $250,000) | Up to 240 months | As low as 7.99% * |

New Camping Trailer or Motor Home (Up to $250,000) | Up to 180 months | As low as 7.99%* |

* Credit criteria apply.

APR = Annual Percentage Rate. Rates shown are the lowest possible rates currently offered. Rates are available based upon your credit profile, year of vehicle and loan terms. Credit criteria apply. As low as rate includes applicable discounts of Premier Member(.15%), Direct Deposit that must be at least 2x monthly loan payment amount(.25%), Automatic Payment(.25%), Previous UCU vehicle borrower(.25%), Financing 89% or lower of vehicle value(.25%) / Financing 75% or lower of vehicle value on 60 months or higher(.50%). (LTV discounts cannot be combined) Rates are fixed for the term of the loan.

Eligibility for the lowest advertised rate is based on creditworthiness, year of vehicle, ability to repay, credit score, down payment, terms and loan to value. Other rates and terms may apply and your rate may differ based on the loan program, term of repayment and other factors. UCU membership required with $5.00 minimum in savings. Member must reside in a state within UCU lending area. Other conditions may apply. Rates and Offers are subject to change without notice. Current UCU accounts must be in good-standing, not have any type of restrictions, and UCU loans paid-to-date.

Auto Loan Example: $15,000 loan at 7.99% APR with 60 monthly payments of approximately $508.58

Boat Loan Example: $20,000 loan at 7.99% APR with 60 monthly payments of approximately $1,017.15

Automobile Vehicle loans: New automobile equals Current Year and Previous Year. Loan To Values based on MSRP/Purchase price on new vehicles or the NADA Retail value plus/minus options and mileage on used vehicles. Model year restrictions apply to 84 month term on used vehicles. Used Auto equals 8 years old or newer. Other conditions may apply.

Rates, Terms and Offers are subject to change without notice. Not all applicants will qualify for the lowest rate. Rates quoted assume excellent borrower credit history. Other eligibility requirements may apply.

Personal Loan Rates

Loan Type | Term | Annual Percentage Rate |

|---|---|---|

Personal Fixed Loan | Up to 60 months | As low as 15.99% ** (Max $20,000) |

Certificate Secured Loan | Up to 60 months | 5.5% over share/certificate rate (Max. $100,000) |

Share Secured Loan | Up to 24 months | 5.5% over share/certificate rate (Max. $100,000) |

* Credit criteria apply.

*Share Secured Loan Example: $10,000 loan at 5.50% APR with 60 monthly payments of approximately $191.01

*CD Secured Loan Example: $10,000 loan at 5.50% APR with 36 monthly payments of approximately $301.96

*Personal Loan Example: $10,000 loan at 15.99% APR with 60 monthly payments of approximately $243.13

Rates, Terms and Offers are subject to change without notice. Not all applicants will qualify for the lowest rate. Rates quoted assume excellent borrower credit history. Other eligibility requirements may apply.

**As low as rate includes applicable discounts of Premier Member(.15%), Existing Direct Deposit (.25%), Automatic Payment(.25%), Existing Auto Loan with Credit Union(1.00%), Rates are fixed for the term of the loan.

Mastercard Credit Card Rates

Mastercard Classic

Revolving

15.99% * (Max $10,000)

Mastercard Gold

Revolving

15.99% * (Max $20,000)

Mastercard Platinum

Revolving

15.99% * (Max $30,000)

Mastercard Secured

Revolving

9.0% (Max $10,000)

* Credit criteria apply.

Monthly University Credit Union loans are calculated using the Simple Interest Method. Interest is calculated on the monthly unpaid balance. Monthly payment amount based upon maximum term. Quoted rates and terms shown may not apply to every borrower. All Credit Union loans are subject to approval and are granted based on individual creditworthiness, the ability to repay and your credit score. Terms and Rates are subject to change.